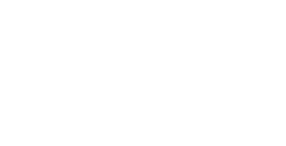

HooYu Identify uses UI/UX tools and customisable KYC steps to minimise customer effort and maximise KYC completion rates. We blend traditional methods of customer verification such as database checks (where available) and PEPS/Sanctions screening with ID document validation, digital footprint analysis, geo-location and facial biometrics.

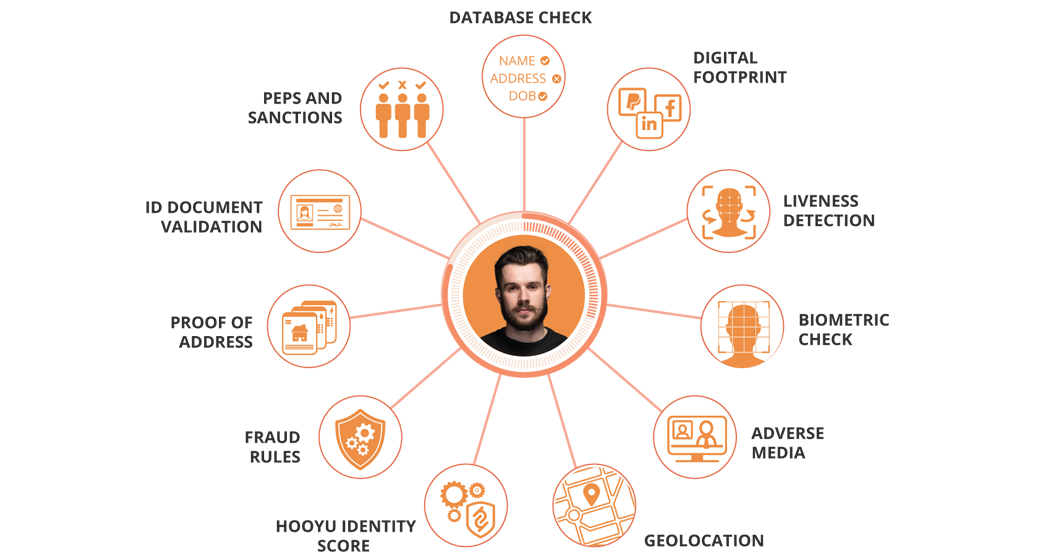

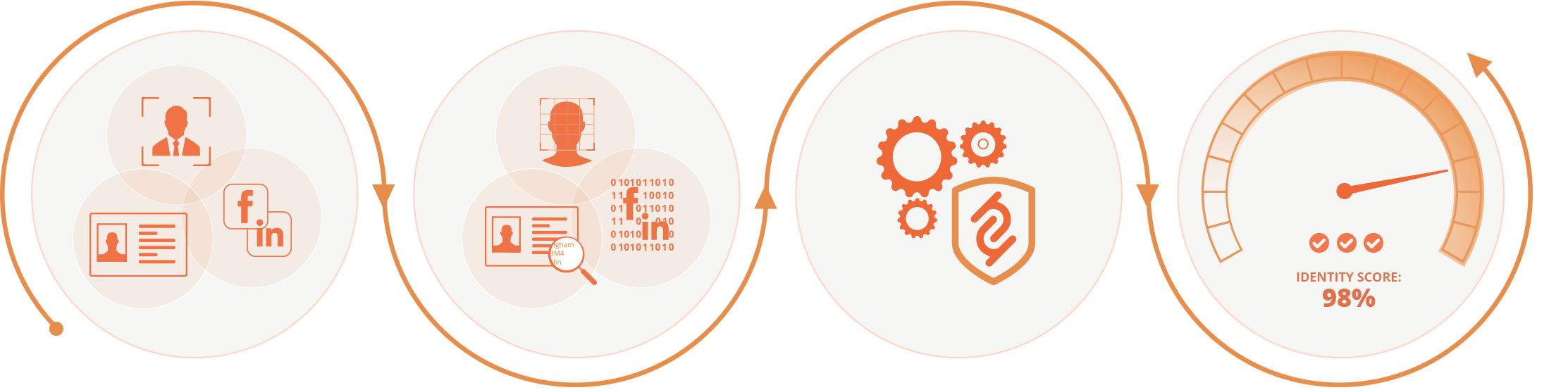

The customer takes a selfie with their mobile or web cam, shares their social media or online account details and takes a picture of their ID document

HooYu completes a biometric facial verification, extracts and scores identity information from the user’s online identity and ID documents and authenticates their ID documents

Identity attributes are cross-referenced, matched and scored against each other to drive an overall identity confirmation score

HooYu generates an identity confirmation report showing how many sources confirm the customer’s identity attributes such as Name, Address, Date of Birth so you can confidently transact with your customer

Watch our interview with Fintech Finance