The HooYu platform blends a range of tools to determine a location score and clients use this location score to help inform the customer onboarding process with automatic passes and caution alerts for review.

For some users, providing an image of a document can be challenging. Our refined UI & UX helps users through the process. Our computer vision engines compare the customer's name and address with their proof of address document image and also check the date on the document to ensure it confirms to client-defined recency rules. Invalid address documents will be rejected, and the user will be guided to upload the address document with correct address and date of issue.

With just a few clicks, clients can configure what address documents they want users to provide and how recent these documents must be. Compliance teams can set custom recency rules per address document type and also create custom messaging to the user to inform them what address documents are not acceptable.

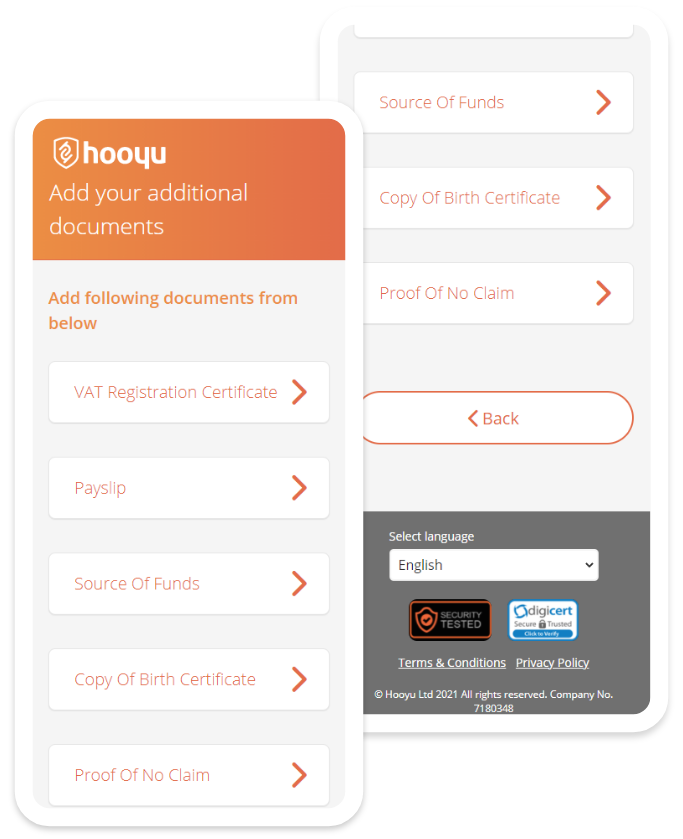

As experts in onboarding, we help our clients to automate and speed up the process when other documentation is required before KYC can be completed.

Clients often extend the HooYu journey to ask customers to provide relevant documents as an attachment upload. Our UI and user engagement reminders make this process quicker and easier for the user and reduce the man hours chasing users for documentation.

Our attachments feature is used by gaming operators to ask for source of funds documents for affordability checks and by banks for Certificates of Incorporation for business account opening.

Director of Payments and Fraud