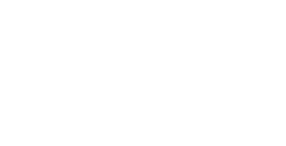

As an initial part of the KYC flow, HooYu can check credit reference agency identity data to help confirm name, address, date of birth and uncover mortality or address flags. Tell us what your use case is and we have several strengths of database check ready to go, whether your goal is age verification, fraud prevention or full KYC.

The best KYC process is one that can be flexed to an individual customer level and HooYu is designed so that clients can sequence database checks with any necessary secondary KYC steps such as ID document validation.

Our Data Search First feature helps remove unnecessary KYC steps where customers have a partial database match and automate fuller KYC steps for customers that have no match or fraud warnings from the database check process.

CEO

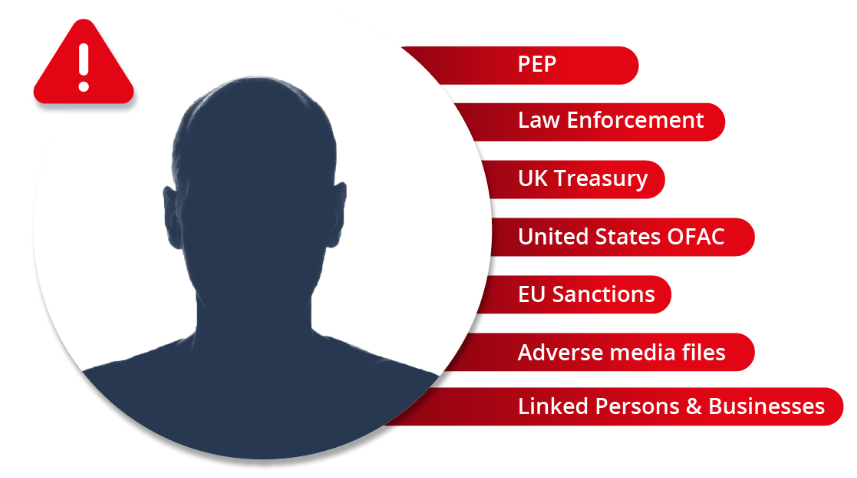

Regulations call for firms to use positive and negative database checks as part of the KYC process. Our platform provides a wide range of alert sources that help our clients make confident decisions when onboarding or re-verifying customers.

Our global PEPs and Sanctions data check service consults over four million records of high-risk individuals and organisations, growing by 25-40k profiles per month and the live Sanctions data is updated every 30 minutes.

HooYu offers a range of identity verification services and deploys them in a single KYC platform that our clients pick and choose from to easily configure and deploy a Know Your Customer journey.

Sadly, not all countries have data sources that are robustly gathered and have high coverage rates. Where there is no viable source of database check, then the HooYu journey comes into its own. To see how we power a global identity verification journey using ID document validation and facial biometrics click here