For clients digitalising offline face-to-face processes where they don't yet have a digital application page, the HooYu start page can be deployed without having to wait for development resource.

It takes just minutes to customise the HooYu journey with client branding such as logos, fonts, colours, and custom button styles.

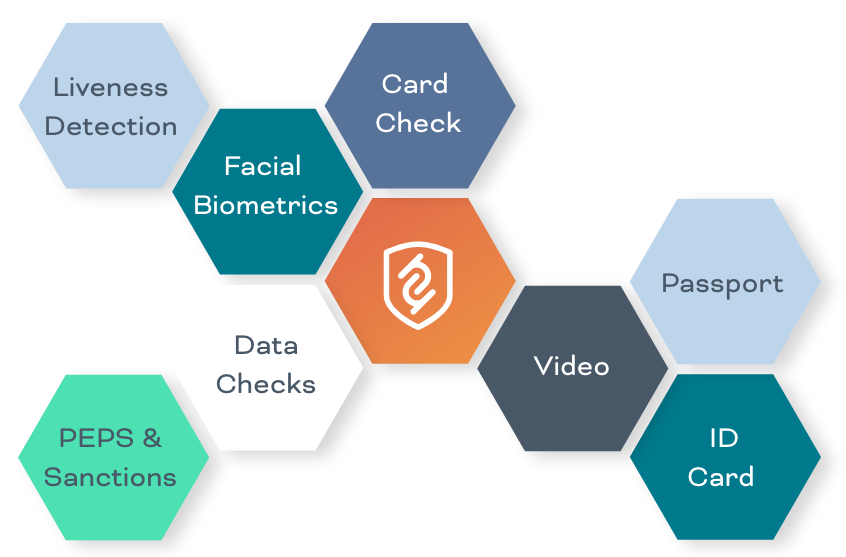

The HooYu platform gives access to a range of IDV tools and empowers clients to design their own journeys with our easy-to-use orchestration tools. Clients can orchestrate different journeys for different risk profiles or geographical regulatory requirements.

Gaming operators such as Betfred or banks such as NatWest or use HooYu to drive a smooth on boarding journey

Financial services firms such as Vanquis Bank use HooYu in their customer services centre to send HooYu requests for risk triggers such as address change requests

Banks use HooYu to issue reverification requests where KYC information has aged and needs refreshing

Gaming operators and financial providers use HooYu to add additional KYC and AML controls at point of pay-out or fund maturation