Schufa

Great news if you operate in the German market! HooYu now has direct integration with Schufa – Germany’s leading provider of credit and information services. Having access to the more than one billion details relating to six million companies and 68 million companies that Schufa holds, enables us to combine Schufa identity data checks alongside facial biometrics and ID document validation, video verification, PEPs and Sanctions watchlist screening and payment card checks to provide a complete solution for the German market.

Thanks to a logic layer built into the HooYu platform, users will be sent into the correct subsequent identity verification journey following a Schufa pass or fail.

Multiple payment cards

If you’re a gaming operator, you may find this new feature particularly helpful. Where a player has more than one card on account, we’ve now made it possible to verify multiple cards within one linked HooYu request. Players can be asked to present any of their cards and HooYu will verify the long card number, masking digits in the same way a single card request is processed.

New caution rules

We’ve added a new set of caution rules. As with existing rules, the new caution alerts can be switched on or off to align with your business and risk requirements. The latest rules can be set to trigger when: a document is submitted without NFC read, and; where there is a disparity between the selfie biometric age and the age detected on a document.

Thank you, no thank you

We’ve listened to your feedback: it is now possible to skip ‘Thank you’ pages, a useful option where you already have a landing page for users informing verification is complete.

For help setting configuring this, or any other, feature on the HooYu dashboard, contact Client Support.

Reject document API

A fan of automation? We’ve enhanced the HooYu API bucket to include automation of document rejection. This functionality already exists on the HooYu dashboard but by creating an API, we’ve allowed for easy integration into our clients’ CRM systems.

For further information on any of these features, including how to test and deploy them, contact your account manager or Client Support.

Bank Connect

Our new service, Bank Connect, extends the HooYu journey by enabling users to prove their identity or affordability status during a KYC process.

Using Bank Connect, users log into their bank account and consent to sharing identity and expenditure data. Access this data helps organisations to graduate from Know your Customer into deeper Understand Your Customer processes, creates stronger identity verification mechanisms and further helps protect consumers from fraud.

As a client, you can select one of four levels of Bank Connect;

Bank Connect ID provides account summary information to help build identity confidence alongside features such as liveness detection and ID document validation.

Bank Connect Affordability enables an understanding of the account holder’s cash flow position and category spend.

Bank Connect Insight provides account summary information plus raw transaction data extracted directly from the bank account.

Bank Connect Affordability Plus combines all three reports including the ID report, Affordability report and Insight report.

To find out more about Bank Connect, watch this video. Or, for a more in-depth demonstration and look into how it could work for your organisation, contact your account manager.

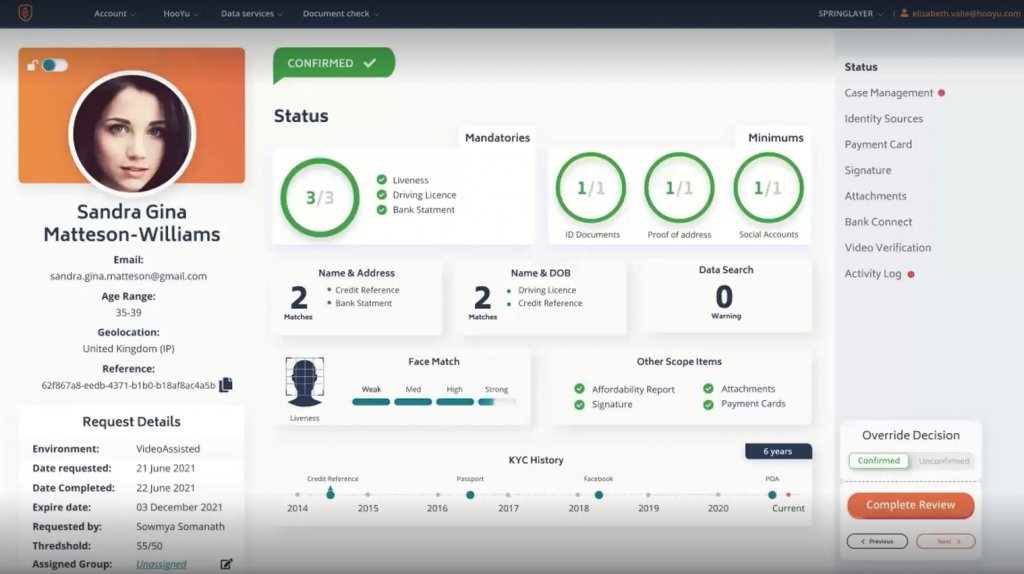

KYC report

| This quarter also sees the availability of a new KYC data block within the results dashboard. What does it show? The data within this block is produced by taking all the identity sources or documents submitted by the user and comparing the name, address and DOB on the documents with the request name, address and DOB. Where we find a match, we highlight those matches in the data block. In addition, the new data block shows a count of the total number of matches we find. Where we are running a credit reference check or looking at social media accounts, for example, and we find a match to the request name, address and/or DOB, we add those results to the data block count. Where a warning results from a PEPs and Sanctions search, we also highlight that in this block. This new data block also makes case review easier with a HooYu generated KYC Report that is also available in the request callback. If you want to enable this feature, please get in touch with Client Support and we’ll get it set up for you. |

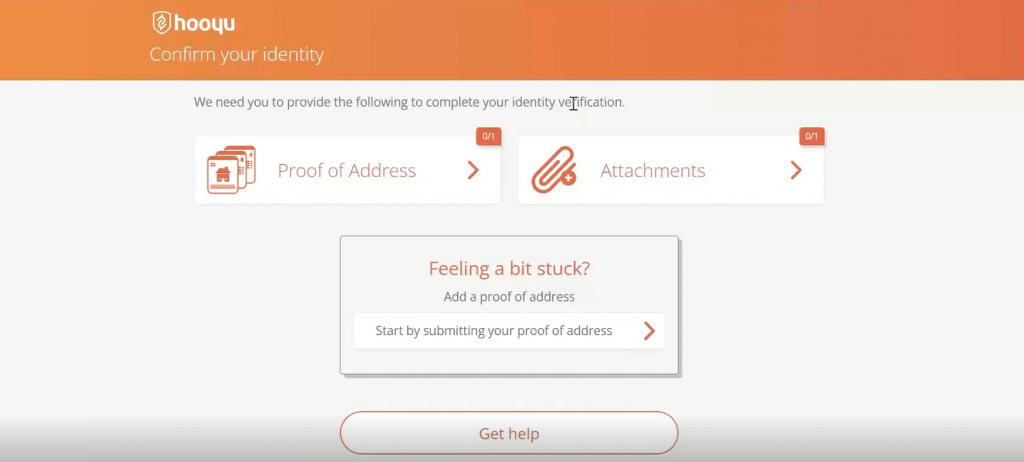

Multipage attachments and Proofs of Address

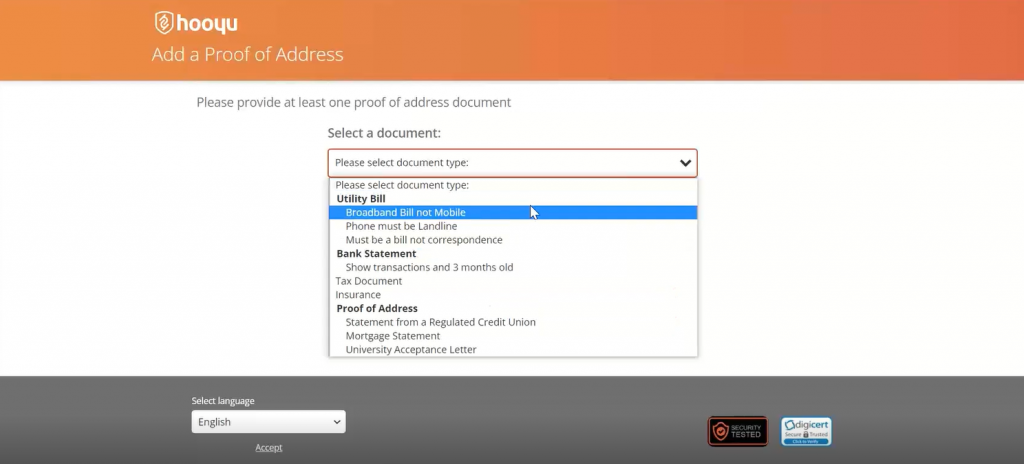

| In response to client feedback, we’ve now made it easier for clients to select the kinds of attachments they will accept, and for end users to upload multipage attachments. Whether it’s an insurance document, bill or certificate of incorporation, we know it’s hard to predict which particular documents a user will want to upload. In the same way we give users options of the documents they can use to prove their identity, we have now introduced categories whereby users are offered a selection of attachments to choose from to prove their income or address. In every environment, we’ve enabled you to set rules determining: – Which documents you will accept (specifying, for example, that you will accept Broadband bills but not Mobile phone bills) – The minimum number of each type of document you are requesting – And the recency of a document (specifying, for example, that utility bills must be less than 3 months old, but council tax bills may be up to 12 months old). |

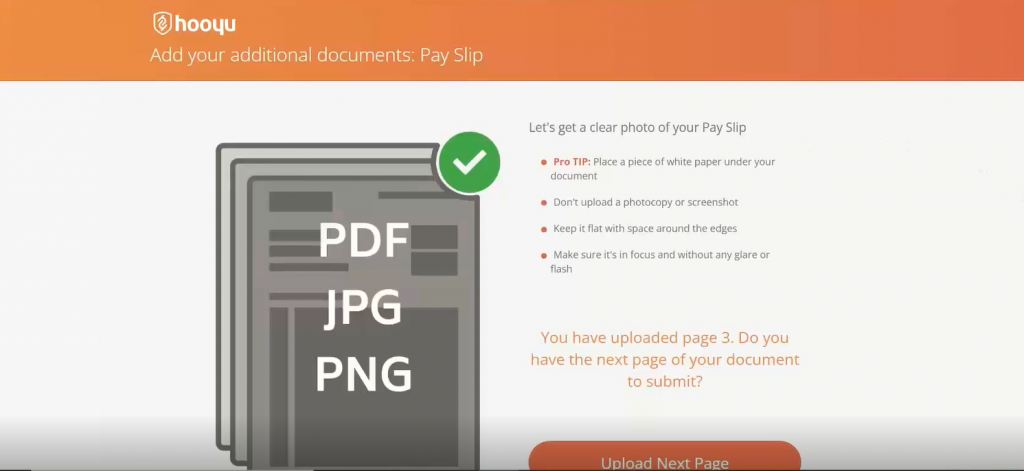

Where clients need to upload more than one page of a document, we’ve made it easier than ever for them to do so with prompts to guide them to upload as many pages as they need and with a landing page informing users that their verification is complete.

All images and uploads are now merged into one document which you, as a client, will receive. By enabling multipage attachments, we’ve not only made it easier for end users to provide their proof, but strengthened the verification process by enabling you to ensure that end users are in possession of the full document rather than just the first page.

For help orchestrating these or any other settings in your end user journey, contact Client Support.

New results dashboard UI

The countdown is on..!

Our new results dashboard has been many months in the making. Working with feedback we received from clients, we’ve focused on improvements to the UI that make it easier to navigate and quicker to find the data you need.

One aspect we’ve addressed is the clarity of the verification status information. We’ve made it easier to find, with a new status bar at the very top of the UI that provides zero-scrolling, at-a-glance answers.

The addition of a new menu, placed down the right hand side of the interface, makes it quicker to navigate between different sections on the page. We’ve improved the case management section so that all information related to the case management, such as comments added, whether a request was assigned to a group, and downloads, are all now in one place which makes case management simpler and the UI, less dense.

We look forward to giving you a guided tour in the near future and introducing you to all the new features!

Decision rules

| Currently, there are three properties which determine whether a request is successful or not: whether or not the minimum confidence score threshold has been achieved; whether the request for mandatory documents has been met, and; whether the minimum number of documents have been uploaded and verified. With our new decision rules feature, a logic layer will provide our clients with better control over the design and configuration of these rules, allowing you to alter the outcome of the verification. |